One of my favorite fortune-cookie messages is “May you live in interesting times.” Like it or not, we are indeed living in interesting times. The COVID-19 global pandemic has washed over the planet, and in the absence of pervasive testing, contact tracing and a proven vaccine, many predict the virus will play out in multiple waves of unknown duration and destructiveness.

Owing to this, we’ve all been forced into some combination of stay-at-home orders, mask-wearing and social-distancing, creating an economic, systemic, and psychic disruption like none seen since the Great Depression. This is truly an unprecedented time, and not in a good way.

The retail landscape is ground zero of this disruption. To put this in numbers, the U.S. economy registered 150 million people employed in April, and the retail industry directly employs about 29 million people and supports more than 42 million jobs. That’s over a quarter of the economy.

To illustrate, when the Cheesecake Factory shut down their retail locations, 41,000 hourly workers were furloughed. That’s a small city of people losing their job from the shutdown of just one restaurant, and a lot of hurting, but that only tells part of the story. When the Cheesecake Factory shuts down, not only do its waiters, cooks and hosts take a direct hit, but so too, do its vendors, suppliers, delivery services and a host of other small businesses that support the restaurant.

Case in point, I have a friend who is a purveyor of fresh fish to fine dining restaurants. When COVID-19 hit, almost all ‘white tablecloth’ restaurants shut down. A 50-plus person company literally saw its revenue drop to zero overnight. Now extrapolate this dynamic to gyms, movie theaters, department stores, sporting goods and salons, and you get a sense of the overwhelming carnage affecting retail and the shopping center business.

The Hard Truth is that EVERYONE has to Write a Check The above should lay clear to everyone how fully the consumer, retailer, worker and vendor are dependent on one another, and that no one is insulated from the potential damage. For the many retailers, this truth, already self-evident in the age of Amazon, is brutal, dark, terrifying, and puts their very survival at risk. For the retail landlord, this truth means that somewhere between 25% and 60% of its tenants are unable to pay their rent, and need rent relief…or else.

That’s a lot of effort to listen to and understand each tenant’s specific case, and get to the right conclusion, be they a national chain with a healthy balance sheet, a merchant in an already struggling retail category or a cash-strapped mom and pop. Aside from the inordinate amount of time involved by a retail landlord to communicate with all its tenants, the challenge is to parse between who’s being fair, who’s taking advantage, who can be saved and is worth fighting for, and for whom this is (all but) the final nail in the coffin.

The unfortunate truth is that everyone in this narrative has to write a check. The tenant has rent and overhead to cover. The landlord has payroll, mortgages, vendors and investors who need to be paid. Hard times indeed.

A Crisis is a Terrible Thing to Waste

Longtime Intel CEO Andy Grove famously said that “Bad companies are Destroyed by crisis, good companies Survive them, and great companies are Improved by them.” I would submit that the “great company” mindset has to be your North Star in this crisis. To make this operational, real and grounded, retail landlords need tools to quickly know where they need to devote their attention and energy to not only survive, but to leverage the learnings and best practices of their peers.

Case in point, the tools below are well within reach and being utilized by many of the savviest landlords:

- Surfacing Key Lease Provisions: One of the first requirements of the crisis, where virtually every retailer was impacted, was the need to understand the durability of the Lease itself. Were there co-tenancy provisions, go dark clauses, force majeure or termi-nation rights? Quickly pinpointing and surfacing this data across the portfolio was and is key to making the best decision in real time.

- Daily Rent Collections Reporting: Most collections reporting is actually delinquency reporting, since in normal times, only the outliers don’t pay. But these are not normal times, and far more than the outliers aren’t paying timely, making this a cash crisis. As a result, the spotlight is on the daily cash collected. Good, accurate reporting makes it easy to look at daily cash collected by portfolio, property or tenant.

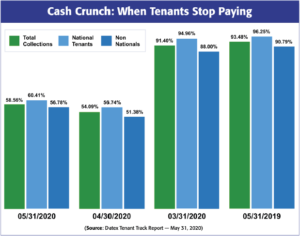

- Who’s Paying Rent & Who’s Not: It is incredibly hard to feel good about much of anything when only

50% of the rent is being collected by month’s end. But understanding relative performance in terms of collections in total, by segment and by national tenant is a critical measuring stick when making some of the biggest decisions of your career, and this is where shared analytics—aggregated and anonymized across multiple portfolios—deliver real value. - Rent Relief Request Tracking: The amount of rent relief requests and the type of details that must be captured over and over can be mind-numbing and ripe for making unforced errors. Not to mention the steps that must occur and various stakeholders contacted to get this lengthy process to the finish line. Today’s products have tools to track and manage these requests.

- COVID-19 is its Own Dataset: Rent Relief Requests (once documented and signed) must be implemented by accounting, who must also make note of the salient details on tenant rent statements. Tracking requests over time, including payback, and operating metrics, like who is open, closed, partially closed, and showing sales strength (or not) requires an orchestrated effort and a purpose-based approach to data collection.

Netting it out: With so much activity going on, now and into the future, you need the right tools to see the right data, so you can make the right choices.

Every Sunset is an Opportunity to Re-set

The crisis is an opportunity to re-think and re-set, and we are already seeing (as part of the rent relief request negotiation process) landlords in the retail sector leveraging this crisis as an opportunity to re-set expectations with their retail tenants (and vice versa) in a number of ways.

One is by securing from the tenant a requirement to regu-larly report sales data, and enforcing those requirements where such rights already exist. This yields better data for benchmarking metrics like occupancy cost and sales per square foot, and ensures that both sides are looking at the true picture in terms of the health of the merchant.

Similarly, with the necessity for landlords to take on more risk by deferring rents for tenants, more landlords are moving to secure percentage rent revenue sharing (based on reasonable breakpoints). This tightens the alignment of interests in a challenging environment. Finally, this is an opportunity for landlords to undo unfavorable lease provisions, and secure early lease extensions where it makes sense.

While the process of getting there is undeniably painful, know this: Every crisis does eventually end, old habits are broken, new rules are written, and with the passage of time, the new normal that emerges feeds the next generation of growth and sustenance.

The smart companies are investing now in building the muscles needed to emerge stronger.